Financial Leverage Explains the Difference Between Roa and Roe

You are assigned to put together a financial report. The following were reflected from the records of War Freak Company.

Dupont Roe Calculation Financial Leverage Return On Assets Roa Explained Driveyoursucce

Return on Equity ROE Net Income Avg.

. Diff --git acoreassetsvendorzxcvbnzxcvbn-asyncjs bcoreassetsvendorzxcvbnzxcvbn-asyncjs new file mode 100644 index 0000000404944d --- devnull b. For instance if ROE is greater than ROA for the same period. Similarly if its value is 1 it means.

Then plug that figure into the following formula. Enter the email address you signed up with and well email you a reset link. This Template is organized into three primary parts.

Part I Part II and the respective data output pages for your respective matrices. This lets us find the. Enter the email address you signed up with and well email you a reset link.

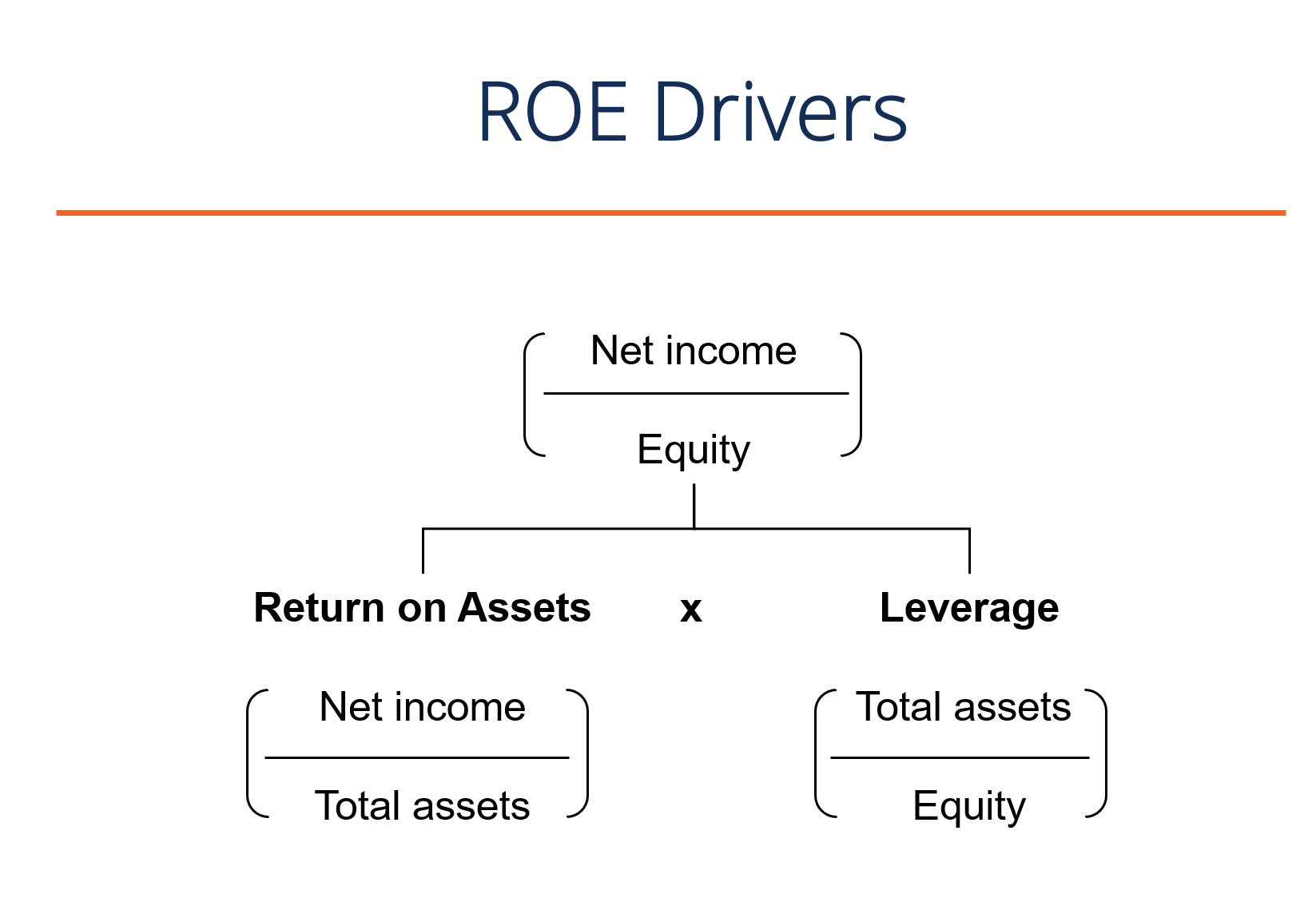

ROE can be analyzed as the product of the net profit margin asset turnover and financial leverage. It is a sign of using leverage to increase profits because higher debt means fewer requirements for equity which will boost ROE. For example as concluded in Alshehhi et al 2018 78 of publications report a positive relationship between corporate sustainability and financial performance.

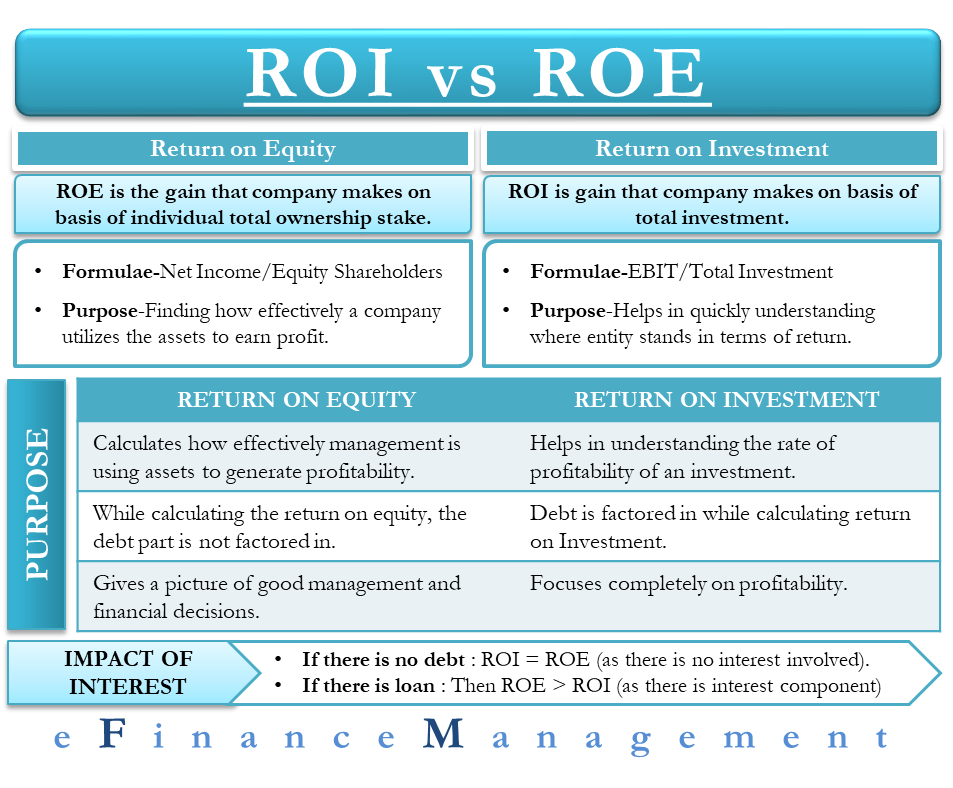

Return on Equity ROE. One primary measure of the balance between funding sources is a leverage metric the Total debt to equities ratio. The primary differentiator between ROE and ROA is financial leverage or debt.

This decomposition is sometimes referred to as DuPont analysis. The list of ratios to be included are as follows. All data entered will be entered into Part I or Part II.

Profitability Return on Assets ROA Net Income Total Assets Create a plan to increase overall income if these ratios are too low as this shows that you are not achieving enough return on your assets or your investors money. If R 2 is 0 it means that there is no correlation and independent variable cannot predict the value of the dependent variable. Defining and Measuring Financial Leverage.

0 Return on Total Assets ROA 0 Return on Stockholders Equity ROE 0 Earnings Per Share EPS 0 Price Earnings Ratio Calculate the ratios for your chosen company for the last three years linking I have Rite Aid. In order to have a chance at competing. Return on equity is a straightforward ratio that measures a companys return on its investment by shareholders.

After-tax Interest Expense 1 Tax Rate x Interest Expense Return on assets is generally stated in percentage terms and higher is better all else equal. You have found the return on equity to be 12 and the debt ratio was 040. What was the return on assets.

This has negative implications for the attractiveness of this market to most companies. This data is used to construct financial statements financial ratios and much more. Adjusted R Squared 1 1 6411 10-1 10 3 1 Adjusted R Squared 4616.

Combined with return on assets ROA return on net worth can show whether leverage is being employed by a company. The relative rates define the companys financial leverage which determines how owners and creditors share business performance risks and rewards. Equity The return on equity figure takes into account the.

Although ROE and ROA are different measures of management effectiveness the DuPont Identity formula shows how closely. R 2 or Coefficient of determination as explained above is the square of the correlation between 2 data sets. Enter in your preliminary financial data below for your company.

A fire has destroyed many of the financial records of R. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Valuation ratios express the relation between the market value of a company or its equity for example price per share and some fundamental financial metric for example earnings.

From a financial perspective standard measures of company performance such as profitability and liquidity ratios as well as economic efficiency measures such as ROA are low for the major players in this market.

Return On Equity Roe Formula Examples And Guide To Roe

Roe Vs Roa Top 5 Differences With Infographics

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

No comments for "Financial Leverage Explains the Difference Between Roa and Roe"

Post a Comment